Canceling your Progressive Insurance policy might seem like a daunting task, but with the right guidance, it can be a straightforward process. Whether you're switching providers, no longer need coverage, or simply dissatisfied with the service, understanding how to cancel your policy is crucial. In this article, we’ll walk you through everything you need to know about canceling Progressive Insurance, including the steps to take, important considerations, and how to avoid unnecessary fees. By the end of this guide, you’ll have a clear roadmap to make an informed decision.

Progressive Insurance is one of the largest auto insurance providers in the United States, known for its competitive rates and customer-friendly policies. However, circumstances change, and you may find yourself needing to cancel your policy. Whether it's due to financial reasons, dissatisfaction with service, or simply finding a better deal elsewhere, it’s essential to approach the cancellation process with care. Mishandling this process could lead to penalties or even legal issues, especially if you’re canceling mid-term.

Before diving into the steps for canceling your Progressive Insurance policy, it's important to understand the implications of doing so. Canceling an insurance policy can have financial repercussions, such as losing your no-claims bonus or facing penalties. Additionally, if you cancel your policy without securing alternative coverage, you may be driving uninsured, which is both illegal and risky. This guide aims to provide you with all the necessary information to cancel your Progressive Insurance policy responsibly and efficiently.

Read also:The Didddy Party Meme A Cultural Phenomenon Explained

Table of Contents

- Reasons to Cancel Progressive Insurance

- Steps to Cancel Progressive Insurance

- Important Considerations Before Canceling

- Fees and Penalties Associated with Cancellation

- Alternatives to Canceling Your Policy

- How to Secure Alternative Coverage

- How to Contact Progressive for Cancellation

- Understanding Progressive’s Customer Support

- Tips for a Smooth Cancellation Process

- Conclusion

Reasons to Cancel Progressive Insurance

There are several reasons why someone might choose to cancel their Progressive Insurance policy. Understanding these reasons can help you determine whether cancellation is the right move for you. Below are some common motivations:

- Finding a Better Deal: Many policyholders cancel their insurance because they’ve found a more affordable option with another provider. Shopping around for insurance is always a good idea, as rates can vary significantly between companies.

- Dissatisfaction with Service: Poor customer service or unresolved claims can lead to frustration, prompting policyholders to switch providers.

- Financial Hardship: In times of economic difficulty, some individuals may need to cancel their insurance to cut costs.

- No Longer Needing Coverage: If you’ve sold your vehicle or no longer drive, maintaining an insurance policy may no longer be necessary.

- Switching to a New Provider: Sometimes, individuals switch to a provider that offers better coverage options or additional perks.

Steps to Cancel Progressive Insurance

Canceling your Progressive Insurance policy involves a few key steps. Below is a detailed breakdown of the process:

Step 1: Review Your Policy

Before initiating the cancellation process, it’s essential to review your policy documents. This will help you understand any terms and conditions related to cancellation, including potential fees or penalties. Pay close attention to the following:

- Policy expiration date

- Cancellation fees

- Refund policies for unused premiums

Step 2: Secure Alternative Coverage

If you’re canceling your Progressive Insurance policy, it’s crucial to ensure you have alternative coverage in place. Driving without insurance is illegal and can result in severe penalties. Consider the following options:

- Shop around for new insurance providers

- Compare quotes to find the best deal

- Ensure your new policy begins before canceling your current one

Step 3: Contact Progressive

Once you’ve reviewed your policy and secured alternative coverage, it’s time to contact Progressive to initiate the cancellation process. You can reach out to Progressive through the following channels:

- Phone: Call Progressive’s customer service line to speak with a representative.

- Online Account: Log in to your Progressive account and navigate to the cancellation section.

- Email: Send an email to Progressive’s customer support team with your cancellation request.

Important Considerations Before Canceling

Before proceeding with the cancellation, there are several important factors to consider. These considerations can help you avoid potential pitfalls and ensure a smooth process:

Read also:Pink Heart Movies A Comprehensive Guide To Romantic Cinema

- Timing: Canceling your policy mid-term may result in fees or penalties. It’s often best to wait until your policy renewal date.

- Refunds: Progressive may issue a refund for unused premiums, but this depends on your policy terms.

- Impact on Credit Score: Frequent cancellations can negatively impact your insurance score, which may affect future premiums.

Fees and Penalties Associated with Cancellation

Canceling your Progressive Insurance policy may come with certain fees or penalties. Below are some common charges you might encounter:

- Cancellation Fee: Progressive may charge a fee for canceling your policy before its expiration date.

- Short-Rate Penalty: Some policies include a short-rate penalty, which reduces the refund amount for unused premiums.

- Reinstatement Fee: If you change your mind and want to reinstate your policy, Progressive may charge a reinstatement fee.

Alternatives to Canceling Your Policy

If you’re considering canceling your Progressive Insurance policy, it’s worth exploring alternatives that might address your concerns without requiring a full cancellation:

- Policy Adjustments: Contact Progressive to discuss adjusting your coverage limits or deductibles to reduce costs.

- Discounts: Ask about available discounts, such as safe driver discounts or bundling options.

- Payment Plans: Inquire about flexible payment plans to ease financial strain.

How to Secure Alternative Coverage

Securing alternative coverage is a critical step before canceling your Progressive Insurance policy. Below are some tips to help you find the best option:

- Compare Quotes: Use online comparison tools to compare rates from multiple providers.

- Check Reviews: Research customer reviews to gauge the quality of service offered by potential providers.

- Evaluate Coverage Options: Ensure the new policy meets your coverage needs and offers adequate protection.

How to Contact Progressive for Cancellation

Contacting Progressive to cancel your policy can be done through several methods. Below is a guide to help you navigate the process:

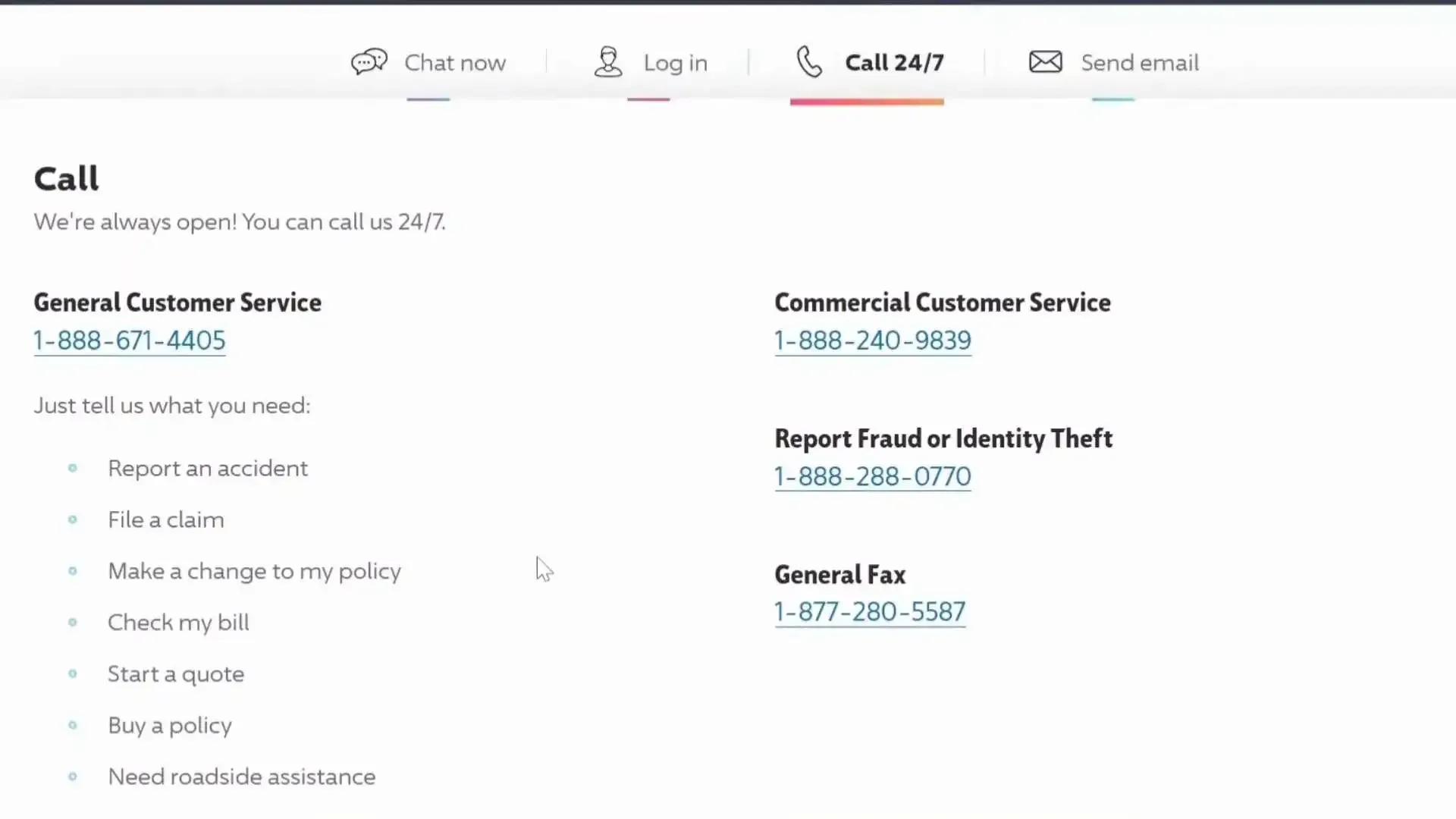

- Phone: Call Progressive’s customer service line at [insert number] to speak with a representative.

- Online Account: Log in to your Progressive account and follow the prompts to initiate cancellation.

- Email: Send an email to Progressive’s customer support team with your cancellation request.

Understanding Progressive’s Customer Support

Progressive’s customer support team is available to assist with policy cancellations and other inquiries. Below are some key points about their support services:

- Availability: Progressive’s customer service is available 24/7 to assist with policy-related questions.

- Response Time: Expect a prompt response when contacting Progressive via phone or online chat.

- Support Channels: Progressive offers support through phone, email, and live chat.

Tips for a Smooth Cancellation Process

To ensure a smooth cancellation process, consider the following tips:

- Plan Ahead: Give yourself ample time to secure alternative coverage before canceling your current policy.

- Document Everything: Keep records of all communications with Progressive regarding your cancellation.

- Ask Questions: Don’t hesitate to ask Progressive’s customer service team for clarification on any fees or terms.

Conclusion

Canceling your Progressive Insurance policy is a significant decision that requires careful consideration. By following the steps outlined in this guide, you can navigate the process with confidence and avoid unnecessary fees or penalties. Remember to secure alternative coverage before canceling, review your policy terms, and communicate clearly with Progressive’s customer support team. If you found this guide helpful, feel free to share it with others or leave a comment below. For more informative articles, explore our website and stay informed about all things insurance-related.